Introduction

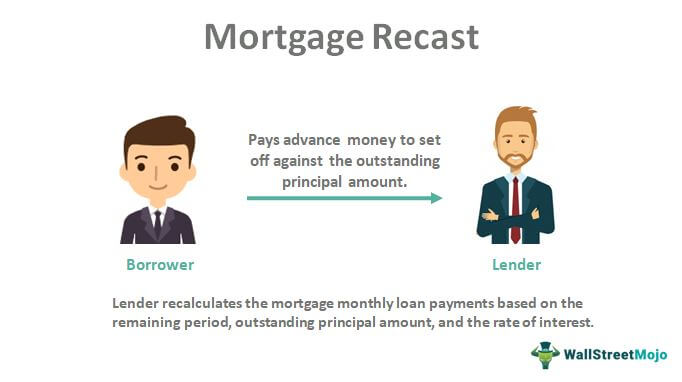

A mortgage recast is an efficient way to reduce your monthly payments and pay off your mortgage sooner. It may be the perfect solution if you've experienced a significant life event, like a job loss or other financial hardship, that requires you to seek relief from high monthly payments. Read on to learn more about why you should consider a mortgage recast.

Lower Your Monthly Payments

One of the primary reasons to consider a mortgage recast is because it can help lower your monthly payments. You'll immediately reduce the amount due each month by making one lump sum payment towards your principal balance and free up some much-needed cash flow. This can be a huge benefit for homeowners struggling to keep up with their mortgage payments.

Pay Off Your Mortgage Sooner

Another significant advantage of a mortgage recast is that it can help you repay your mortgage sooner. By making an extra payment towards the principal, you'll be reducing the amount owed and thus shortening the length of your loan term. This will save you money on interest costs in the long run and make it easier to become mortgage-free faster.

Avoid Refinancing Fees

Refinancing is another option for those looking to lower their monthly payments or shorten their loan term; however, it can come with high fees and closing costs. A mortgage recast is a great way to avoid these fees and still get the same benefits. With a recast, you won't have to pay additional fees or costs; you need to make one lump sum payment toward your principal balance.

Flexibility in Repayment Terms

Another advantage of a mortgage recast is that it gives you more flexibility regarding repayment terms. Unlike refinancing, which requires you to start over with new loan terms, a mortgage recast allows you to keep the same loan term but with extra payments. This makes it much easier for homeowners who want more control over their finances without jumping through hoops.

More Affordable Than Refinancing

Finally, a mortgage recast is often much more affordable than refinancing. As mentioned above, no fees or closing costs are associated with a recast. Plus, the process is typically much faster and easier than refinancing. This makes it ideal for those who need to lower their payments quickly without spending too much money.

Factors to Consider For a Mortgage Recast

Deciding whether a mortgage recast is right for you depends on several factors. Considering all these factors, you can determine whether a mortgage recast is right for you and your financial situation. Here we will explore some of these considerations.

Interest Rate

The interest rate is the first factor to consider when looking at a mortgage recast. If your current interest rate is low enough, it may not make sense to refinance into another loan with higher rates. Additionally, refinancing usually comes with additional closing costs that could significantly increase your overall loan balance.

Loan Term

Another factor to consider is the length of the remaining mortgage term. If you have a mortgage with a few years left, it may not make sense to pay off the entire loan since there will need more time to benefit from the lower monthly payments. In this case, it may be more beneficial to refinance into a longer-term loan to stretch out your payments over an extended period and potentially reduce them even further.

Credit Score

Your credit score can also play a role in whether or not you should pursue a mortgage recast. If your credit score has improved since taking out the original loan, you could qualify for lower interest rates, resulting in lower monthly payments. However, if your credit score has declined since the original loan was taken out, you may need help to qualify for a mortgage refinance or recast.

Cash Flow

Finally, you should consider your current financial situation when deciding whether or not to pursue a mortgage recast. If you have extra monthly money, it may make sense to use those funds to pay your mortgage faster. However, if you are already having difficulty making your monthly payments, it could be better to pursue other options, such as refinancing or a loan modification.

Conclusion

A mortgage recast is an efficient way to reduce your monthly payments and pay off your mortgage sooner. It can benefit homeowners who have experienced financial hardship or are looking for more flexibility regarding repayment terms. Plus, it's much more affordable than refinancing and doesn't require additional fees or costs. If you think a mortgage recast may be the right solution, speak with your loan officer today.